Navigation Points

Lodestar Wealth's Investment Blog

February 2nd, 2021

GameStop, Silver and the Reddit Rebel Effect

We were hoping that 2021 would get off to a quiet start. Then the GameStop short squeeze happened. It reminds me of the 1999-2000 period – back when money grew on trees. I have a few war stories of my own to share … someday.

In 2021, the internet is well-seasoned compared to 1999. Thank goodness, given that we have a pandemic raging. We also have around 33 million young men aged 20-34. Several million of them have discovered Robinhood while in lockdown. It turns out this makes for an interesting mix. It’s like a virtual keg party, what could possibly go wrong?

I don’t plan on covering the GameStop (GME) story here. It is certainly not a rational event. Entertaining? Absolutely - but not rational. After all, GameStop’s fundamentals are terrible: selling copies of video games through mall stores isn't going to make you money in 2021. Unless the company had an equity shelf offering ready to go (to raise capital and reinvest in the business) it is not likely the company will be able to use the price movement to its advantage. Regardless of whether the Reddit Rebel Effect (RRE) is rational is beside the point. The fact is, the RRE moves markets and that is the key takeaway of the GameStop saga.

In addition to GameStop, there are several other stocks and ETFs on the Reddit Rebel radar. These are mostly thinly traded vehicles with high short interest. The Silver ETF (SLV) is one such investment. Interestingly, a client called me today and told me he had a slug of SLV in an IRA we don’t manage. The client has owned silver and gold for a while given his concerns about inflation.

After joking about what he will do when silver gets to $1,000 an ounce (currently in the mid $20s) he asked my thoughts on whether he should do anything. It occurred to me that we could help frame the topic in the context of the Gold-to-Silver Ratio, which is just the price of gold divided by the price of silver (both per ounce). Given this client is a savvy investor, I decided we could “geek out” on the Gold-to-Silver Ratio topic.

Granted, this is probably too sterile of a framework. Rationality does not appear to count these days when it comes to investing, but having the ratio is handy given it provides a nice relative value approach.

Like most rabbit holes I find myself in, this one also began with a R session. R is an open source software language respected for its data science packages. One great aspect of R is the plotting software. I ended up plotting a line graph, a histogram and an informative violin plot to illustrate different aspects of the Gold-to-Silver ratio.

This Gold-to-Silver ratio line plot goes back to 1975 — so we have a good amount of historical data.

The first thing that jumps off the page is how high the ratio was less than a year ago. I presume gold rallied on the pandemic fear and silver — known more as a cyclical commodity given its myriad of industrial uses — sold off with the economic shutdown. Despite the sharp rally in silver over the past week or so, the ratio is not out of whack. In fact, it still appears to favor gold. The horizontal line represents the average ratio value.

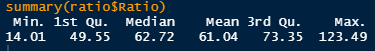

The second plot I generated was a histogram to examine the distribution of the ratio over that same 46-year period. For context, I have listed the summary statistics for the Gold-to-Silver ratio:

The number on the far left, a ratio of 14, represents one extreme (silver expensive relative to gold). The number on the far right represents the other extreme (gold expensive relative to silver). Most observations were between the values of 50 and 75. 75% of values were above 49.55 and 75% were below 73.3. Today’s ratio of approximately 67 was still above the mean of 61. In other words, if the Reddit Rebels want to pile into the Silver ETF to drive the price up, there appears to be a lot of room for that ETF to run.

The final plot is a violin density plot with a few variables overlayed. I get made fun of a lot for using this plot. It is well-deserved; many ask if I am administering a Rorschach test. But this is my data blog and I am going to include a violin plot if I want. The wider the violin, the more often the Gold-Silver Ratio returned to that value. It’s that simple. The black lines represent deciles. The blue circle reflects the average value. The red circle is the most recent ratio between Gold and Silver.

With this information, I suggested to the client that he might hold on to SLV and to consider lightening up his exposure if the ratio gets below 50, indicated by the green horizontal line on the violin plot. For this to happen, the Silver ETF would have to continue its run up and reach about $37 an ounce, assuming the price of gold remains steady.

This is where we find ourselves in 2021 (a year that is beginning to feel like 2020 The Sequel), at the intersection of fundamental value investing and the Reddit Rebel Effect. Silver could open 30% higher tomorrow for the aforementioned reasons or peel off like GameStop – one never knows. I told the client I doubt SLV will get as crazy as GME did – it is not likely to jump to $100 given it is a lot more liquid security. It’s a good problem to have, assuming you are not shorting silver. The client seemed to like our framework. He was happy with how we put Silver prices in historical context to Gold, while not totally dismissing the RRE. Moreover, from a portfolio construction standpoint, everything is still viewed in a Goals-Based prism as we keep plugging toward his goals. And with the wisdom of someone who is closer to the finish line than the starting point, the client left me with this about the Reddit Rebels: "I hope these young turks appreciate how crazy these times will seem years from now. But in the meantime, I guess we'll let her ride."

- CRH

Sign Up for Our Newsletter

Polaris Portfolios

We've updated the Lodestar website to include a new section on our Polaris Portfolios. These Portfolios incorporate Lodestar Wealth's Goals-based investment philosophy while putting an emphasis on efficiency. The Polaris Portfolios are available on Charles Schwab's Institutional Intelligent Portfolio Platform. Click here to learn more.

Goals-Based Planning

Our team will partner with you to tailor a goals-based plan specific to your needs. We focus on understanding your objectives and

implementing global asset allocations aimed at achieving your financial goals.

HSA & Financial Health Education

Underutilized and often misunderstood, HSAs can bridge the savings gap for your family. Our innovative consulting process

will help reframe the HSA conversation.

Investment Advisory

We provide an array of investment

advisory services for all types of

individuals adhering to a strict fiduciary code. Our portfolio construction process is centered on a durable, goals-based methodology.