Dear Friends:

Fall is upon us.

Turning the calendar page to October means playoff baseball, pumpkin everything, and market volatility. While The October Effect is largely psychological, October historically has been the most volatile month.1 Financial markets in the third quarter started to exhibit more volatility in both the bond and equity markets. There were plenty of drivers of the increased volatility: economic concerns tied to the Delta variant, tighter monetary policy amidst rising inflation, concerns over Chinese real estate, and most recently, the threat of a government shutdown. As discussed in prior letters, both the fixed income and equity market valuation profiles are stretched and thus priced for perfection. The number of potential exogenous shocks – both economic and geo-political – appears to be rising. There is growing chatter about the US losing its reserve currency status given concerns over last year’s public spending and President Biden’s potential $3.5T Build Back Better Act.

Below are Q3 2021 total returns for select equity and fixed income asset classes (Source: YCharts):

The Bloomberg Commodity Index posted the highest quarterly return of all indices we track in our quarterly letters. While it is still too early to determine whether the recent spike in inflation is just ‘transitory’ or structural in nature, two concerns are quite clear: shortages are a real issue and the growth in the money supply does not seem to be moderating.

Shortages. The other day I went into Target to purchase some swim goggles for my son. That turned out to be delusional as seemingly half the outdoor and sporting goods section was barren. Here is a photo of the bicycle ‘supply.’ I hope Santa has got plenty of elves this year because he has his work cut out.

It’s kind of strange to see money supply plots like this one below and ten-year bond yields still hovering towards record lows:

If the old adage “inflation is too much money chasing too few goods” holds water, I’d say inflation’s future is promising!

Polaris Portfolios

We've updated the Lodestar website to include a new section on our Polaris Portfolios. These Portfolios incorporate Lodestar Wealth's Goals-based investment philosophy while putting an emphasis on efficiency. The Polaris Portfolios are available on Charles Schwab's Institutional Intelligent Portfolio Platform. Click here to learn more.

Fixed Income: At Least Mortgages Rates Are Cheap

Congratulations if you were in the market to purchase a new home in the past 2 years: it is highly unlikely you will be refinancing your note any time soon. The above chart normalizes 30-year rates and plots the rate change over the past 3 years. Be careful about extrapolating recent housing appreciation; we believe housing now joins many other global asset classes as a candidate for lower-than-average prospective returns. Indeed, if the Fed is forced to raise rates sooner than expected we could see a modest decline in the national Case-Shiller housing index.

The market certainly believes the recent spike in inflation is “transitory” in nature. Gold and the one-year inflation expectation has exhibited a relatively high correlation until recently. While it is still too early to discern if higher inflation is here to stay, we like gold’s risk-return profile. We particularly like gold’s risk-return profile compared to the 10-year US Treasury Bond! The S&P US Treasury Bond Current 10-Year Index is down -4.17% YTD and -5.98% over the 1 Year period ending September 30th. Imagine what will happen to the 10-year Treasury if inflation is here to stay and rates begin to rise.

Equities: All Eyes on Washington

Last quarter we opined that Sen. Joe Manchin (D-WV) was the nation’s most powerful man. In hindsight, we may have understated the importance of Manchin along with fellow moderate Kyrsten Sinema (D-AZ). Both senators hail from deep Red States and place a premium on bipartisanship and fiscal responsibility. In keeping with those traits, Manchin and Sinema have been adamant that they would not support a proposed $3.5 trillion budget reconciliation package that largely focuses on increased social program spending, while pushing for a vote on the bipartisan Infrastructure Investment and Jobs Act (who’s chief Democratic sponsor is Sinema).

President Biden has made the Infrastructure Bill and Social Spending Package the centerpieces of his agenda. going so far as to threatening to veto his own Infrastructure Bill if it comes to his desk without the Spending Bill. By linking the two pieces of legislation and allowing Progressives in the House to hold the Infrastructure Bill hostage, Biden has managed to not only alienate Republican Senators (19 of which voted for the Infrastructure Bill) but to create in-fighting within his own party. We are now dealing with a fractured Democratic party – Progressives v. Moderates – in addition to the already divided Republican party. The jostling has led to a high-stakes game of chicken over the debt ceiling. While Congress was able to raise the limit this week, McConnell - in a rather strong letter to Biden - has double downed on his refusal to help again. Even with the current debt ceiling crisis avoided with a short-term extension, a new one will arise in two months. Should the Republicans hold firm on their threats to have Democrats own the spending issue, we face the very real possibility of defaulting on our Treasury debt.

The prospect of the US not making good on its payments has rattled the capital markets. The S&P 500 was off 1.3% on October 4th underscoring concerns around the debt ceiling and inflation (the Personal Consumption Expenditures Index hit a 30 year high on September 30th). Interest rates have ticked higher on the news.

The saga around the Infrastructure Bill and debt ceiling are just two more of the many symptoms stemming from a plague endemic to our nation: partisanship. President Biden’s approval ratings have fallen to new lows. What should have been an easy and much needed victory by passing the bipartisan Infrastructure Bill has turned into a debacle. Biden has not only lost his ability to reach across the aisle, but he also now faces challenges within his own party. The Republicans should feel confident in their ability to win back the House or Senate during next year’s mid-terms. With inflation spiking, we can expect monetary policy to continue to tighten (the Fed has already announced their intentions for their November meeting). The stimulus that has kept the markets surging upward will be coming to an end in mid 2022. If Washington continues to be ineffective, unable to pass sensible legislation that can provide economic relief, expect things to get ugly for the capital markets.

There is still a window for both Congress and Biden to regain some favor. Congress needs to pass the bipartisan Infrastructure Bill and come to a resolution on the budget with or without the spending package. Biden, for his part, needs to have a strong showing when he meets with Chinese President Xi Jinping during their virtual summit later this year.

Geopolitical: Chinese Property is no Field of Dreams

Countless articles covering Chinese ghost cities have been written over the years. A key component of Beijing’s economic strategy has been to build out cities to attract rural residents since the mid 1990’s. According to the Financial Times, China’s property & real estate sectors comprise 29% of its national GDP. Several financial journalists posited China was nearing its ‘Lehman Moment’ when news broke in late September that China’s Evergrande was on the verge of collapse. Evergrande, the world’s most indebted developer, is defaulting on its bond payments. A collapse of Evergrande could mean huge losses for the 171 Chinese banks and 121 other financial institutions, as well as countless individuals who have lent money or paid deposits to Evergrande. The current question worth mulling is whether the government will step in to avoid a cascading contagion scenario. Pundits believe it will eventually, but it is safe to say that China’s growth miracle is facing hard times. The hypothesis that urbanization would drive growth has not been proven wrong, however. In 1950, 13% of China’s population lived in cities. Today that number is above 60% with a goal to have 70% urbanized by 2025. China’s economic boom has gone hand in hand with urbanization, as their GDP has grown 245X over the last 40 years. If the property problem is contained, there could be room still to grow in Emerging Markets.

Geopolitical: A Note on Afghanistan

August’s end also marked the conclusion of a nearly 20-year Allied Forces occupation of Afghanistan. In many respects, that crisp, sunny Tuesday of September 11, 2001 seems like yesterday. That we have avoided a terrorist attack on the same scale of 9/11 should not be taken for granted. In this respect, the lives lost during the global War on Terror — including those lives lost in late August — were not lost in vain. Afghanistan was a policy fail, not a military failure.

In addition to the lives lost, the financial cost of the War on Terror is almost incalculable. It is in the trillions of dollars. The recent budgetary hole caused by the invisible enemy in the coronavirus is enough to wreak financial havoc on our economy for another 20 years. Aside from stating the rather obvious — that the nation building playbook should probably be jettisoned for good, (particularly in Afghanistan!) — the government debt profile simply cannot sustain future Afghanistans.

Allied intelligence capabilities will certainly require continued investment if we are to avoid future terrorist attacks. Taxes will have to be increased to fund investment in technology and human sources on the ground. It would be a beacon to other jihadists in countries such as Syria, Nigeria, Somalia, and other hotspots if the Taliban in Afghanistan meets with even a modicum of success in running the country. The best the western world can hope for is that infighting between jihadist groups distract them from softer western targets. One can also hope that a 20-year occupation yielding 90 million female school years will serve as a check on the historically oppressive Taliban policy.

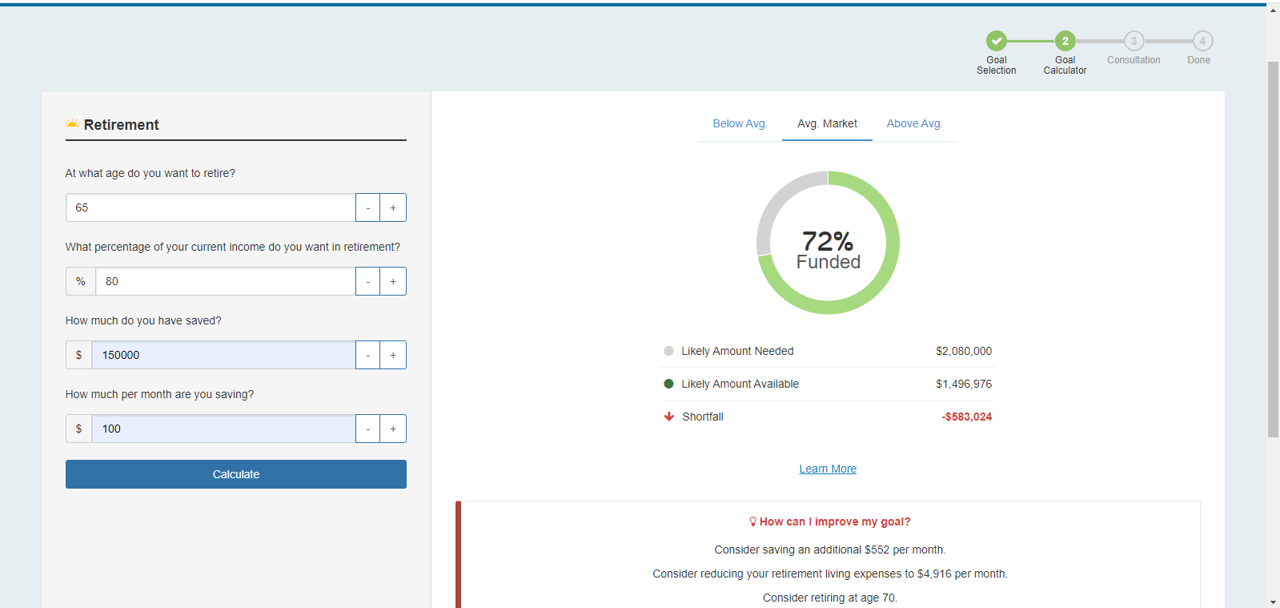

Financial Planning Made Simple

Lodestar Wealth employs a Goals-Based framework when working with our clients. In short, how we invest is a function of what your goals are and where you are in meeting them. Through eMoney, we have an avenue to track your goals, as well as provide financial planning best practices, identify gaps or needs in your plan, and share important documents and information in a secure digital vault. Use the link below for a quick check on where you are in hitting your goals.

Goals-Based Portfolios

If you have sat in on any of our Investment Committee Meetings over the past quarter, you would have a good understanding of why Lodestar Wealth has a corporate budget allocation for Tums. At no point in our combined 40+ years of experience have we seen a market as confounding as this. Valuations are stretched, fixed income is a land-mine, and fundamentals appear to be inconsequential as the markets keep chugging higher. Anyone sticking with the old “Balanced” 60/40 portfolio because of heuristics and antiquated research is sure to find disappointment over the next decade. And while the obstinate equity market continues to favor complacency, we take solace in our Goals-Based Investing Framework. By combining Goals-Based Investing with Goals-Based Financial Planning, we can take a more conservative approach given the current market conditions while keeping our clients on track to achieve their goals.

A portfolio’s asset allocation is often ‘optimized’ to maximize the account’s overall risk-adjusted return. Optimization refers to the math that determines the – you guessed it – ‘optimal’ – exposure to each asset class. This process should be done with a very healthy degree of skepticism because the output (portfolio weights of each investment) is influenced by historical results. In a recent exercise at an Investment Committee Meeting, we asked the question “How much would an optimizer love the 20-year treasury as a solid diversifier/risk reducer for a balanced portfolio?” The algorithm’s answer was “I really love it – in fact, max out the exposure based on any constraints.” This is potentially dangerous because if the recent economic inflation turns out to be structural and not ‘transitory,’ that 20-year treasury exposure will not likely turn out to be a good diversifier. Instead, albeit more volatile, commodities may be a better exposure in terms of preserving purchasing power. In conclusions, we believe investors will need to grow more comfortable with taking on more unconventional exposures in their portfolios. We have never been gold bugs, but we are increasing our gold exposure in our ETF strategies because we believe it may inherit a risk-reduction role at the portfolio level from fixed income asset classes.

We thank you for the opportunity to serve and please don’t hesitate to reach out with any questions as we prepare for the end of the year!

- Carl & James

Sign Up for Our Newsletter

Goals-Based Planning

Our team will partner with you to tailor a goals-based plan specific to your needs. We focus on understanding your objectives and

implementing global asset allocations aimed at achieving your financial goals.

HSA & Financial Health Education

Underutilized and often misunderstood, HSAs can bridge the savings gap for your family. Our innovative consulting process

will help reframe the HSA conversation.

Investment Advisory

We provide an array of investment

advisory services for all types of

individuals adhering to a strict fiduciary code. Our portfolio construction process is centered on a durable, goals-based methodology.

Investing involves risk. Investment risks include general market risk and risks related to economic conditions or special risks, such as those related to investments in foreign securities, small- and mid-capitalization stocks, and high-yield securities. Underlying investments fluctuate in price and may be sold at a price lower than the purchase price resulting in a loss of principal. The underlying investments are neither FDIC insured nor guaranteed by the U.S. Government. There may be economic times where all investments are unfavorable and depreciate. Asset allocation cannot eliminate the risk of fluctuating prices and uncertain returns. Clients may lose money. Past performance is not a guarantee of future results. Investors should read the prospectus carefully and consider the fund’s investment objectives, risks, charges and expenses before investing. Prospectuses are available on the investment web site, or by contacting the fund directly. The information in this material is not intended as tax or legal advice and solely expresses the opinion of Lodestar. Please consult legal or tax professionals for specific information regarding your individual situation. Investment advisory services are offered through Lodestar Wealth Public Benefit, LLC (Lodestar Wealth). Lodestar Wealth is registered as public benefit corporation in the state of Delaware and is a registered investment advisor in the state of Massachusetts.